Capital costs must be deducted to determine the true economic viability of the operation rather than just its cash flow. In commercial beekeeping, calculating producer surplus requires subtracting the investment in hardware—specifically machinery and beehives—along with the shadow cost of labor from the total revenue. This ensures the final figure represents the actual net profit generated after necessary infrastructure investments.

Core Takeaway

Producer surplus in this context is a measure of the "input-output ratio" for pollination as an investment. By deducting capital costs for hardware, the metric shifts from a simple revenue check to a sophisticated indicator of net profit and investment efficiency.

The Components of Accurate Valuation

To understand the true value of a commercial beekeeping enterprise, you must look beyond top-line revenue.

Accounting for Hard Assets

Beekeeping is capital-intensive. You cannot generate revenue without significant upfront investments in beekeeping machinery and beehives.

If you calculate surplus without deducting these costs, you are inflating the perceived value of the business. You would be counting the return on capital as part of the surplus, rather than accounting for the cost of that capital.

The Shadow Cost of Labor

While your question focused on hardware, the calculation also demands the deduction of the shadow cost of labor.

This represents the opportunity cost of the work put into the operation. By combining hardware costs with labor costs, you create a comprehensive view of total inputs.

The Input-Output Ratio

The primary goal of this specific calculation is to evaluate pollination as an agricultural investment.

Measuring Investment Efficiency

The reference defines this calculation as a key indicator of the input-output ratio.

This ratio tells you how efficiently capital is being converted into value. By deducting the cost of hives and machinery, you isolate the value created above the cost of the tools required to create it.

Defining Net Profit

In this framework, producer surplus is effectively synonymous with net profit following investment.

It answers a critical question for the producer: After paying for the infrastructure that makes the business possible, what value actually remains?

Understanding the Trade-offs

While deducting capital costs provides a conservative and accurate view of viability, there are nuances to consider.

Long-Term vs. Short-Term

Deducting capital costs immediately provides a "net" view, but hardware like machinery has a useful life of many years.

This calculation treats these costs as immediate deductions to determine current surplus. This is excellent for solvency analysis but may obscure cash flow in years where no new equipment is purchased.

The Strictness of the Metric

This approach is more rigorous than standard "cash basis" accounting.

It forces the producer to acknowledge that machinery and hives are liabilities until they have paid for themselves. This prevents the illusion of profit in the early stages of a commercial expansion.

Making the Right Choice for Your Goal

To apply this to your own commercial analysis, consider what you are trying to measure.

- If your primary focus is Investment Viability: Deduct all machinery and hive costs immediately to determine if the input-output ratio justifies the capital risk.

- If your primary focus is Operational Efficiency: Ensure you include the shadow cost of labor to see if the operation is sustainable beyond just paying for the hardware.

Ultimately, accurate producer surplus calculation protects you from overestimating the profitability of your agricultural assets.

Summary Table:

| Factor | Description | Impact on Producer Surplus |

|---|---|---|

| Hard Assets | Beekeeping machinery, hives, and tools | Deducting reveals return on capital vs. simple revenue |

| Shadow Labor | Opportunity cost of manual labor | Ensures the operation is sustainable beyond hardware costs |

| Net Profit | Revenue minus all capital & labor inputs | Defines the true economic viability of the enterprise |

| Input-Output Ratio | Efficiency of capital conversion | Determines if pollination serves as a viable investment |

Maximize Your Beekeeping Investment with HONESTBEE

To achieve a positive producer surplus and a superior input-output ratio, commercial apiaries and distributors require durable, high-efficiency equipment. HONESTBEE empowers your business with a comprehensive wholesale range, including:

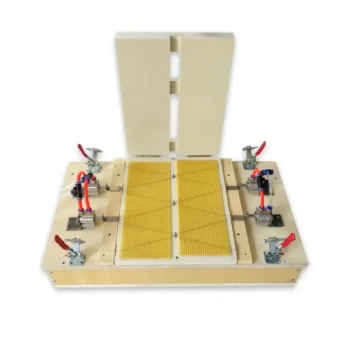

- Precision Machinery: Advanced hive-making and honey-filling machines to reduce long-term labor costs.

- Quality Infrastructure: Robust beehives and professional-grade beekeeping tools built for commercial scale.

- Consumables & Merchandise: A full spectrum of industry essentials and honey-themed cultural goods.

Ready to optimize your operational efficiency and protect your bottom line? Contact HONESTBEE today to discuss our wholesale solutions and bulk pricing for your apiary or distribution network.

References

- Navaraj Upadhyaya, Kalyani Bhandari. A Review: Pollinator Services and Its Economic Evaluation. DOI: 10.46676/ij-fanres.v3i2.85

This article is also based on technical information from HonestBee Knowledge Base .

Related Products

- Beehive Handle and Frame Rest Cutting Machine: Your Specialized Hive Machine

- Professional 3-Bar Frame Grip with Integrated Hive Tool

- Automatic Pneumatic Bee Frame Machine for Eyelet Insertion

- Professional Pneumatic Wire Embedder for Beehive Frames

- Automatic Finger Joints Joint Making Machine for Bee Box and Hive Making

People Also Ask

- What role does standardized beehive equipment play in professional apiculture? Drive Efficiency and Yield

- What does every bee keeper need? Your Essential Guide to Starting Strong

- Why does the Improved Box Hive system require a higher dependency on specialized machinery? Precision vs. Tradition

- How does the application of statistical analysis tools and data-driven software contribute to optimizing beekeeping?

- What are the differences in price and equipment availability for 8-frame and 10-frame hives? Choose Your Hive Wisely